Maxine S. was 77 years old, a retired kindergarten teacher who needed money to care for her son suffering from Lou Gehrig’s disease.

Robert H., then 73, was a retired financial analyst at JPL. He and his wife, a retired assistant principal, needed money to pay for the care of her 92-year-old father. Michael H., then 66, was a retired technical director at Fox Sports. All he and his wife, then 66, a retired schoolteacher, wanted was a secure retirement.

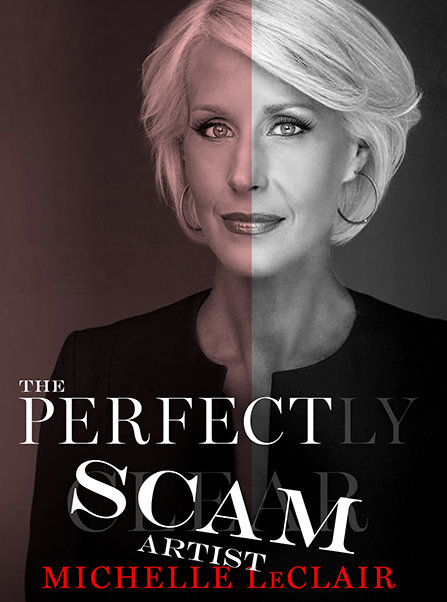

These were the typical victims Michelle LeClair—then known as Michelle Seward—targeted as prey for her investment scams, the ones she now insults by rewriting her history despite more than 5,000 pages of public documents, a permanent injunction and restitution order signed by a judge and a plea agreement with the Los Angeles County District Attorney’s Office.

LeClair’s book is nothing more than her latest cynical get-rich-quick moneymaking scheme. Add to that a media tour aimed at shamelessly trying to blame others for her misdeeds instead of taking personal responsibility for her malfeasance. Finally, LeClair promotes a preposterous paranoid theory that she was the victim of a grandiose conspiracy between her former religion, the state of California and the Los Angeles County District Attorneys’ Office to bring about her downfall.

Her effort to cast herself as a victim instead of apologizing to her real victims is reprehensible. Court documents say she was at the center of a Ponzi scheme in which elderly, unsophisticated seniors were specifically targeted, often entrusting their life savings to her that they were counting on to pay for food, housing and medical care during their retirement. Court papers note that LeClair even cynically proclaimed at one presentation that she was “tired of seeing seniors being taken advantage of by the financial industry” when her scam was doing just that.

Court documents say Seward was at the center of a Ponzi scheme in which elderly, unsophisticated seniors were specifically targeted, often entrusting their life savings to her that they were counting on to pay for food, housing and medical care during their retirement.

Court documents show LeClair went to great lengths to deceive the seniors she victimized, misrepresenting to the elderly investors that their money would be used to develop movies such as the box office dud Not Forgotten when it was being used to pay prior investors, which is the classic definition of a Ponzi scheme.

Documents also state that she failed to let them know that sales agents earned commissions on funds raised, failed to inform them of risks of the highly speculative investment, claimed that the investment was “secure” and told investors that the investment was “rock solid.”

In responding to one investor who asked if it was a “Bernie Madoff type deal,” she responded that it was “safe,” according to court documents.

It was the perfect hunting ground for LeClair to find her victims. In fact, she represented that she was part of an organization that protected seniors from fraud.

These allegations were made in an action brought by the California Department of Corporations, which secured a permanent injunction and restitution order signed by a Superior Court judge.

By contrast, LeClair’s book is her fictional account. It’s the one in which she claims she was vindicated and tries to escape responsibility for her actions, all of which flies in the face of the plea deal she cut and the permanent injunction and restitution order signed by a judge.

But there are real victims who, unlike Michelle LeClair, are innocent and suffered. Here are some of their stories as told through court documents: